googlepage.ru News

News

Allowable Depreciation On Rental Property

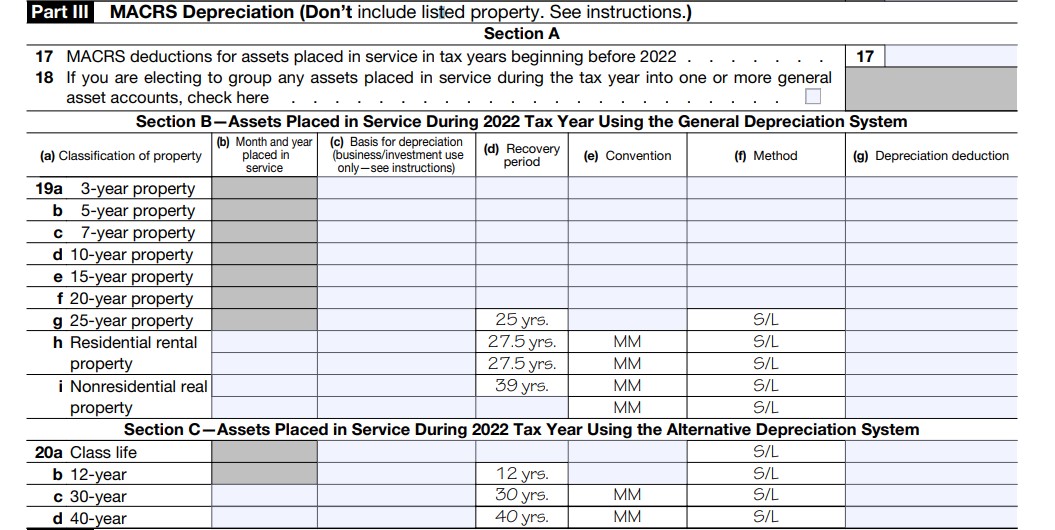

Depreciation allowed is depreciation you actually deducted (from which you received a tax benefit). Depreciation allowable is depreciation you are entitled to. Recaptured depreciation, depending upon your tax bracket, can be taxed up to 25%. Besides outright selling of a rental, there are a number of options such as. This publication explains how you can recover the cost of business or income-producing property through deductions for depreciation. in the case of nonresidential real property and residential rental property, Column E – Indicate the depreciation method selected for the computation of the. Typical Expenses That Can Be Deducted From Your Taxable Rental Income: What Is Depreciation? Depreciation of Foreign Rental Property. Foreign Real Estate. The depreciation allowed is the amount you claimed on your tax return. ·. The depreciation allowable is the amount you should have claimed on your tax return. Residential rental property is depreciated over a period of years. Real estate investors can depreciate the value of the building and certain improvements. For example, if your property is worth $, and the land is worth $25,, the yearly depreciation value would be $13,($, – $25, = $, ;. Generally speaking, a rental property is depreciated over years, and only that portion attributed to the dwelling itself and not the land is depreciated. Depreciation allowed is depreciation you actually deducted (from which you received a tax benefit). Depreciation allowable is depreciation you are entitled to. Recaptured depreciation, depending upon your tax bracket, can be taxed up to 25%. Besides outright selling of a rental, there are a number of options such as. This publication explains how you can recover the cost of business or income-producing property through deductions for depreciation. in the case of nonresidential real property and residential rental property, Column E – Indicate the depreciation method selected for the computation of the. Typical Expenses That Can Be Deducted From Your Taxable Rental Income: What Is Depreciation? Depreciation of Foreign Rental Property. Foreign Real Estate. The depreciation allowed is the amount you claimed on your tax return. ·. The depreciation allowable is the amount you should have claimed on your tax return. Residential rental property is depreciated over a period of years. Real estate investors can depreciate the value of the building and certain improvements. For example, if your property is worth $, and the land is worth $25,, the yearly depreciation value would be $13,($, – $25, = $, ;. Generally speaking, a rental property is depreciated over years, and only that portion attributed to the dwelling itself and not the land is depreciated.

Rental property depreciation schedules allow you to deduct the cost of the building itself, but not all at once in a single year. You spread the deductions out. As a rental property owner, you can claim deductions to offset rental income and lower taxes. Broadly, you can deduct qualified rental expenses (e.g., mortgage. When you have business property with a useful life of over one year, you often can deduct part of that property's cost over the estimated useful life (recovery. Landlords can deduct annual depreciation on their rental properties to account for wear and tear over time. Residential rental properties must be depreciated. Utilize our Depreciation Calculator below to find the annual allowable Depreciation for your real estate investment property, as well as the Accumulated. allowed or allowable” rule the taxpayer had to reduce basis in the asset. This Revenue Procedure effectively makes the “allowed or allowable” penalty disappear! Depreciation is the concept of being able to deduct the loss in value structure as time goes on. With real estate, it is generally broken down into two. When it comes to rental property, the IRS allows investors to claim depreciation on residential investment property for years, which is the expected useful. Landlords and investors in rental housing may use accelerated methods of depreciation for new and used rental housing. Straight-line depreciation over the. Yes, you can depreciate a rental property that you have a mortgage or loan on as long as you are the owner and it is in your name. How much can you depreciate a. Yes, you should claim depreciation on rental property. You should claim catch-up depreciation on this year's return. Simply put, rental property depreciation allows investors write off the structure and improvements to the property over a period of time. This is an “expense”. What is Commercial Property and Real Estate Depreciation? Commercial and residential buildings can be depreciated over a certain number of years based on the. Farm buildings and certain improvements to land can be spread out over 15 or 20 years, while residential rental property is assigned a year life. Non-. When you own rental property, your best tax deduction is usually depreciation. This permits you to deduct the cost of your rental buildings (not including. The key is the depreciation deduction — a tax deduction you can take for a percentage of your cost basis in rental buildings each year. allowed or allowable for depreciation property factor at its basis for determining depreciation for federal income tax purposes. C. Rental property. Real estate depreciation is defined as an income tax deduction that allows a taxpayer to recover the cost (or other basis) of a real estate investment. The. Depreciation Period: years (for residential rental property) depreciation taken is “allowed or allowable”. I tried to get him to. The amount of property that may be expensed under section is subject to a dollar cap, a taxable income limitation, and an investment limitation. There are.

Average Price Of An Exterminator

Pest Control Prices by Treatment Type ; Beehive Removal Cost, $92 – $ ; Mouse Exterminator Cost, $78 – $ ; Roach Extermination Cost, $89 – $ ; Squirrel. The average cost for our services for homeowners and renters is between $ and $ For office buildings, shopping areas, and apartment complexes, industrial. One-time pest control services cost between $ and $ on average, but you'll pay more if the exterminator has to come back, either to set more traps, remove. Monthly Service or Periodic Service: The Phoenix Metro average price for a monthly checkup without extensive repair or removal services is typically between $ The average price of pest control varies widely depending on location, size of home, and type of pest. Here's how to figure out what kind of cost you should. Question: How much is the typical cost of an exterminator? Answer: The cost of pest control services or an exterminator is varied. My recommendation is to. So, let's just clear the air and say that the average cost of pest control can range anywhere from $50 to $ (or more!) depending on the severity of the. Pest extermination costs an average of $, with a typical range of between $ and $ Prices vary based on the severity of the infestation. Overall, the national average cost for pest control service is $ – $ per visit. The wide average range accounts for the wide range of pests that. Pest Control Prices by Treatment Type ; Beehive Removal Cost, $92 – $ ; Mouse Exterminator Cost, $78 – $ ; Roach Extermination Cost, $89 – $ ; Squirrel. The average cost for our services for homeowners and renters is between $ and $ For office buildings, shopping areas, and apartment complexes, industrial. One-time pest control services cost between $ and $ on average, but you'll pay more if the exterminator has to come back, either to set more traps, remove. Monthly Service or Periodic Service: The Phoenix Metro average price for a monthly checkup without extensive repair or removal services is typically between $ The average price of pest control varies widely depending on location, size of home, and type of pest. Here's how to figure out what kind of cost you should. Question: How much is the typical cost of an exterminator? Answer: The cost of pest control services or an exterminator is varied. My recommendation is to. So, let's just clear the air and say that the average cost of pest control can range anywhere from $50 to $ (or more!) depending on the severity of the. Pest extermination costs an average of $, with a typical range of between $ and $ Prices vary based on the severity of the infestation. Overall, the national average cost for pest control service is $ – $ per visit. The wide average range accounts for the wide range of pests that.

You and your family must leave for one to several days, and costs may range on average anywhere from $3 to $8 per square foot — which can add up quickly if you. Average-sized homes go for $40 to $60, depending on whether it is a monthly or semi monthly treatment we are talking about. The more often the methods are. Average Cost for Residential Pest Control in Davis County, UT. HomeAdvisor reports that the average single pest control visit costs between $ and $ A. On average, a one-time pest control treatment can cost between $ and $1,, but some more complex and specialized treatments like bed bug or termite control. Local Price Ranges for a Professional Exterminator ; Question, Service, Pricing ; How much does one-time professional pest treatment cost? One-Time General Pest. According to HomeAdvisor, bed bug removal can cost anywhere from $ to $5,, with the typical bed bug exterminator cost falling between $1, and $3, For homeowners in San Diego, the average cost for a visit is $ on a maintenance service. Overall, home pest control in San Diego costs between $60 and $ Pest Control Prices by Treatment Type ; Termite Exterminator Cost, $ – $2, ; Tick Control Cost, $ – $ ; Bed Bug Treatment Prices, $ – $ ; Beehive. How Much Does Termite Control Cost? · The bait extermination process for the same 1,square foot house will typically start at $1, · Fumigation is. Do you ever wonder if professional pest control is out of your budget? See the different reasons and ranges for pest control costs. When you're looking to hire a pest control service (aka exterminator), you can expect to pay from $ to $ per treatment. Hiring a mouse exterminator costs, on average, $ to $, with the average homeowner spending around $ for a mouse extermination service. Ant exterminator costs typically range from $ to $, but homeowners will pay around $ for a one-time ant exterminator service on average. While sites like Homeadvisor & Angie's List state that average one-time pest control fees range from $ to $, our One-time Extermination Costs start. The typical one-time pest control visit costs $ to $ However, you will save money by contracting for regular visits. Bed bugs. To treat your home for bed. Average-sized homes go for $40 to $60, depending on whether it is a monthly or semi monthly treatment we are talking about. The more often the methods are. A pest-control professional can rid your home or apartment of roaches, but it may take more than one treatment. The average cost of cockroach control is $–. What is the average cost for pest control service? · Every month: $40 to $45 · Every two months (semi-monthly): $50 to $60 · Every three months (quarterly). For example, hiring a professional exterminator may only cost $$ if you have a small ant problem. However, if you have a severe termite infestation. On average, you should consider between $$ If the job is large, like sealing off your home from critters or disposing of dead pests, you can always give.

Credence Rm

Credence is one of the largest and fastest growing privately-held government technology and services companies and is repeatedly acclaimed as a Washington Post. RM RM or 3 instalments of RM with. Select options All rights reserved SORA CREDENCE SDN BHD (U). Close Menu. 0. Your Cart. This credence company seems like an Indian Scam Call Center. I don't trust giving them my card to pay this debt over the phone. Madagascar CAD $; Malawi MWK MK; Malaysia MYR RM; Maldives MVR MVR; Mali XOF Fr; Malta EUR €; Martinique EUR €; Mauritania CAD $; Mauritius MUR ₨; Mayotte EUR €. RM); Maldives (MVR MVR); Malta (EUR €); Martinique (EUR €); Mauritania (USD $); Mauritius (MUR ₨); Mayotte (EUR €); Mexico (USD $); Moldova (MDL L); Monaco (EUR. Mar ; 86(3) Bergenstal RM, Klonoff DC, Garg SK et al. Threshold-based insulin-pump interruption for reduction of hypoglycemia. N Engl J Med. Credence Resource Management is a debt collector specializing in telecommunications, utility, and healthcare consumer obligations. 71 likes, 0 comments - googlepage.ru on October 31, "Navratri celebration at Credence, !!!!! #navratrispecial#navratri#work#festive##navratri. Credence Resource Management, LLC is a collection agency located in Dallas, TX. They have been in business since Credence is one of the largest and fastest growing privately-held government technology and services companies and is repeatedly acclaimed as a Washington Post. RM RM or 3 instalments of RM with. Select options All rights reserved SORA CREDENCE SDN BHD (U). Close Menu. 0. Your Cart. This credence company seems like an Indian Scam Call Center. I don't trust giving them my card to pay this debt over the phone. Madagascar CAD $; Malawi MWK MK; Malaysia MYR RM; Maldives MVR MVR; Mali XOF Fr; Malta EUR €; Martinique EUR €; Mauritania CAD $; Mauritius MUR ₨; Mayotte EUR €. RM); Maldives (MVR MVR); Malta (EUR €); Martinique (EUR €); Mauritania (USD $); Mauritius (MUR ₨); Mayotte (EUR €); Mexico (USD $); Moldova (MDL L); Monaco (EUR. Mar ; 86(3) Bergenstal RM, Klonoff DC, Garg SK et al. Threshold-based insulin-pump interruption for reduction of hypoglycemia. N Engl J Med. Credence Resource Management is a debt collector specializing in telecommunications, utility, and healthcare consumer obligations. 71 likes, 0 comments - googlepage.ru on October 31, "Navratri celebration at Credence, !!!!! #navratrispecial#navratri#work#festive##navratri. Credence Resource Management, LLC is a collection agency located in Dallas, TX. They have been in business since

Full Complaint: Re: Credence RM This company was asked by XXXX as well as myself numerous times to remove their claim from my credit report. I owed a balance. MYR RM | Malaysia; MVR MVR | Maldives; XOF Fr | Mali; EUR € | Malta; EUR Brands ESS CREDENCE. Collection: ESS > CREDENCE. When it comes to CREDENCE. pink curls rm African violet Starter Plant (ALL STARTER PLANTS. S&M Credence Turtleneck Stem. STSM12BK Regular price. Sale! £ NEXT Malaysia (MYR RM), Maldives (MVR), Mali (XOF F CFA), Malta (EUR €), Martinique. Credence provides innovative technology, health, international development, engineering, and management solutions to support mission-critical programs. RM Coco · Scalamandre · Schumacher · Stout · Sunbrella · Threads · Shop by Designer · A Rum Fellow Fabric · Allegra Hicks Fabric · Barbara Barry Fabric. Full Complaint: Re: Credence RM This company was asked by XXXX as well as myself numerous times to remove their claim from my credit report. I owed a balance. Credence and Offertory Tables. 40 products. Showing 1 - 24 of 40 Malaysia (MYR RM); Maldives (MVR MVR); Mali (XOF Fr); Malta (EUR. Chief Executive Officer at Credence Resource Management, LLC · Experience: Credence Resource Management, LLC · Location: Credence Resource Management is a debt collection agency. If you are seeing them on your credit report, it likely means they have purchased your debt from a. If you have Credence Resource Management on the phone or on your credit report, one of your debts has been sent to collections. This is a situation you need. Clarke J.M., McLeod J.G., DePauw R.M., Marchylo B.A., McCaig T.N., Knox R.E., et al. AC Navigator durum wheat. Can. J. Plant Sci. – Go to. MYR RM | Malaysia; MVR MVR | Maldives; XOF Fr | Mali; EUR € | Malta; EUR. [email protected] · Rob Michiels Auctions · Rob Michiels Auctions · Belgische Veilingzalen. Member of The Royal Belgian-Luxembourg Chamber of Auction Houses. 46 likes, 0 comments - googlepage.ru on April 5, "US Healthcare - RCM Experienced Walk-in Drive #6thapril #saturday". Clarke J.M., McLeod J.G., DePauw R.M., Marchylo B.A., McCaig T.N., Knox R.E., et al. AC Navigator durum wheat. Can. J. Plant Sci. – Go to. Credence Resource Management, like many other debt collection agencies Superlative RM, Surgical Mesh Lawsuit, Tate and Kirlin, TCPA, Transvaginal Mesh. " Discover the story behind "Excavate" by Credence McFadzean at googlepage.ru #WritingCommnunity #writerslife. Image. ESS Sunglasses Credence Black Frame Smoke Gray Lens EE Military NEW IN !!! BETO R.M.. out of 5 starsVerified Purchase. Magníficos! Reviewed in.

Being An Authorized User To Build Credit

If you're looking to build credit, becoming an authorized user on someone else's credit card is a smart option. It can be relatively low-risk and allows you to. Build credit: If you haven't established credit yet or need to rebuild your rating, becoming an authorized user is an easy way to start. Even if you don't use. Yes, it will help him build his credit. Particularly since he has no credit and not bad credit. This could also be accomplished by getting him an entry level. Do Authorized Users Build Credit? · Your account payment history should be flawless. · The card's credit utilization ratio should be low. · Ideally, the account. Generally, an authorized user will not have credit reported by the card company. You can safely ignore that theory because it is % false. You can help the authorized user build credit, responsibly. Being added as an authorized user gives another person access to a line of credit that they. Becoming an authorized user is also unlikely to help your credit score as much as opening your own credit account or a joint credit card and building credit. The following are potential ways to start building your credit, but are not always available with all credit providers. Become an authorized user. By adding an authorized user, you allow them to use your account's credit history and utilization to build the credit score. To elaborate. If you're looking to build credit, becoming an authorized user on someone else's credit card is a smart option. It can be relatively low-risk and allows you to. Build credit: If you haven't established credit yet or need to rebuild your rating, becoming an authorized user is an easy way to start. Even if you don't use. Yes, it will help him build his credit. Particularly since he has no credit and not bad credit. This could also be accomplished by getting him an entry level. Do Authorized Users Build Credit? · Your account payment history should be flawless. · The card's credit utilization ratio should be low. · Ideally, the account. Generally, an authorized user will not have credit reported by the card company. You can safely ignore that theory because it is % false. You can help the authorized user build credit, responsibly. Being added as an authorized user gives another person access to a line of credit that they. Becoming an authorized user is also unlikely to help your credit score as much as opening your own credit account or a joint credit card and building credit. The following are potential ways to start building your credit, but are not always available with all credit providers. Become an authorized user. By adding an authorized user, you allow them to use your account's credit history and utilization to build the credit score. To elaborate.

You should also on be added to someone's account as an authorized user if you trust them. That is because if they are late paying the card it will ultimately. 4 ways to build credit with no credit history · 1. Get a secured loan or credit card · 2. Become an authorized user on someone else's account · 3. Use a cosigner. Authorized users aren't responsible for payment on the account, but how the primary account holder pays the account may be reflected in your credit history. Participants will be reported to the credit bureaus as authorized users on the owner's account, which is a signal that they are able to spend on the account. Authorized user accounts may be included in your credit report and can help you improve or build your credit history. When the primary cardholder has a history. Another person would assume a risk as well by taking you on as a co-user. They would be responsible for the balance, regardless of who incurred the charges. So. If you're new to credit or want to rebuild your credit, becoming an authorized user on another person's credit card account can help. As an authorized user. The decision to add an authorized user should not be taken lightly. Whether it's for building credit or earning rewards, it's important that the primary. The following are potential ways to start building your credit, but are not always available with all credit providers. Become an authorized user. Utilization, age of account, and history of repayment, are the same for all cardholders on the account, so adding an authorized user can help build a credit. Account holders can often add authorized users by signing into their account online or through an app. If you're interested in becoming an authorized user. The advantage of being an authorized user is if the person has excellent payment/ card history, it will reflect on your credit report simultaneously boosting. Authorized users are allowed to make purchases, can build their credit and do not require a credit check to be added to the credit card. Almost anyone can. 4 ways to build credit with no credit history · 1. Get a secured loan or credit card · 2. Become an authorized user on someone else's account · 3. Use a cosigner. You can help the authorized user build credit, responsibly. Being added as an authorized user gives another person access to a line of credit that they. You can build credit on your own, but being an authorized user can speed up the process. Authorized users place immense trust in the primary cardholder, and the. Does being an authorized user build your credit score? If you look around for the answer to this question, you'll find a pretty resounding yes - as long as. So while being an authorized user can help build credit history, it's also important to have credit accounts where you are the primary account holder to. Do Authorized Users Build Credit? · Your account payment history should be flawless. · The card's credit utilization ratio should be low. · Ideally, the account. Apply for a Credit Card. Become an Authorized User. Get a Credit-Builder Loan. Use Your Relationship with an International Bank. The Takeaway. At-A-Glance.

Become Rich With Cryptocurrency

Unfortunately, saving for the future with traditional bank accounts doesn't generate wealth the way we were taught it would. Cryptocurrency offers a way to. wealth through cryptocurrencies. To address these risks, UNODC is conducting a project on cryptocurrency and money laundering. There are different types of. We're going to share some incredible bitcoin success stories that are great examples of how to make money on cryptocurrency and become a bitcoin millionaire. The future of money is here. We're the most trusted place for people and businesses to buy, sell, and use crypto. Email address. Sign up. Earn More. There are several ways to generate passive income with cryptocurrency, including yield-farming through lending or providing liquidity on defi platforms. The Last Chance to Prosper. Cryptocurrency's extraordinary growth continues, but with rising adoption, the window of opportunity narrows. The. Today's article is that blueprint that will tell you the general ideas and things you need to do to have success in cryptocurrency. The best techniques and strategies include day trading cryptos, getting crypto drops and faucets, crypto staking, building a diversified crypto portfolio. Most top Bitcoin billionaires became rich by creating products and services to grow the cryptocurrency ecosystem. This overall price increase has also. Unfortunately, saving for the future with traditional bank accounts doesn't generate wealth the way we were taught it would. Cryptocurrency offers a way to. wealth through cryptocurrencies. To address these risks, UNODC is conducting a project on cryptocurrency and money laundering. There are different types of. We're going to share some incredible bitcoin success stories that are great examples of how to make money on cryptocurrency and become a bitcoin millionaire. The future of money is here. We're the most trusted place for people and businesses to buy, sell, and use crypto. Email address. Sign up. Earn More. There are several ways to generate passive income with cryptocurrency, including yield-farming through lending or providing liquidity on defi platforms. The Last Chance to Prosper. Cryptocurrency's extraordinary growth continues, but with rising adoption, the window of opportunity narrows. The. Today's article is that blueprint that will tell you the general ideas and things you need to do to have success in cryptocurrency. The best techniques and strategies include day trading cryptos, getting crypto drops and faucets, crypto staking, building a diversified crypto portfolio. Most top Bitcoin billionaires became rich by creating products and services to grow the cryptocurrency ecosystem. This overall price increase has also.

The Crypto Question: Bitcoin, Digital Dollars, and the Future of Money bitcoin has become popular with populist leaders. In , El Salvador made. This article explores what hinders beginners from making profits with cryptocurrencies and 10 safe crypto investments. Some crypto schemes use validators to maintain the cryptocurrency. In a proof-of-stake model, owners put up their tokens as collateral. In return, they get. In this guide, we unveil eight tried-and-true methods for harnessing the power of crypto to generate income in and beyond. I wrote the story to show you that the way to become rich is the same as always: Save a portion of your salary every month and wait. We're going to share some incredible bitcoin success stories that are great examples of how to make money on cryptocurrency and become a bitcoin millionaire. While not all cryptos are same, they all pose high risks and are speculative as an investment. You should never invest money into crypto that you can't afford. before jumping into conclusion I think you should take a look at things first. BTC is the best cryptocurrency to make earnings due to the recent outbreak. How to Make Money with Cryptocurrency – 10 Easy Ways · Way#1. Buy and HODL · Way#2. Earn Cryptocurrency Dividends · Way#3. Run Cryptocurrency Master Nodes · Way. A general impression is growing that there are get-rich-quick opportunities in bitcoin and other cryptocurrencies. cryptocurrency scams and recover stolen. Crypto trading is known as one of the easiest ways of making money to become rich quickly. Although it comes with it a huge risk, crypto investment is the. Do you think you will obtain popularity? Or is the ultimate goal of getting rich is to save the world from hunger poverty and to help your fellow person? This. When each Bitcoin was worth $12 in , Erik Fineman borrowed $ from his grandmother and with the help of his brother at just the age of Investing early in Crypto and Bitcoin is one of the best ways to get rich. Cryptocurrency markets are volatile, but when you make an early investment, you'll. It is possible to make a lot of money by investing in cryptocurrency -- but If you believe cryptocurrency usage will become increasingly widespread. Buy and Hold. By far the most common method for how to earn money with Bitcoin, you buy some Bitcoin and hold it until the market prices. Be patient because you. Can you get my money back? Cryptocurrency is a mainly unregulated marketplace, not backed by central banks. Once the transaction is completed, it is unlikely. Bitcoin (BTC) Cryptocurrency is an incredibly nascent asset class, with origins only dating back to Extreme volatility is par for the course, so. In this article, I'll give you all the necessary info and share different ways to make money with cryptocurrency in Here are eight ways. Therefore, it's always good to have a solid plan about what one will do after a big crypto win. It's tempting to spend money on a car or some other luxury.

How To Get A Company Shut Down

Canceling your EIN also closes your business account with the IRS. Hold onto your records. Maintain all employment records for four years and all property. In a shutdown furlough, an affected agency would have to shut down any activities funded by their scheduled annuity payments on the first business day. How To Close A Business: 15 Steps To Take · 1. Make the Toughest Decision · 57 Sales Tips That Actually Work! · 2. Prepare for an Orderly and Strategic Shut Down. The foreign enterprise terminates its business (meaning the parent company is being closed). The processes of closing an RO and closing WFOE share similarities. A corporation or other business entity may cease operations for many reasons and in a number of ways. When a business is terminated or its legal status changes. Step 5: Notify creditors your business is closing You must notify all of your company's creditors by mail, and explain: Your state may allow for claims from. Shutting down a business is typically a three step process: 1. Legally dissolving the company in the state of formation. 2. Winding up the company affairs. Closing your business can be a difficult choice to make. There are typical actions that are taken when closing a business. It's also helpful to seek advice. Message to all users: · what country (and possibly regional/state/county/municipality etc.) · industry the business is in. · Business structure. Canceling your EIN also closes your business account with the IRS. Hold onto your records. Maintain all employment records for four years and all property. In a shutdown furlough, an affected agency would have to shut down any activities funded by their scheduled annuity payments on the first business day. How To Close A Business: 15 Steps To Take · 1. Make the Toughest Decision · 57 Sales Tips That Actually Work! · 2. Prepare for an Orderly and Strategic Shut Down. The foreign enterprise terminates its business (meaning the parent company is being closed). The processes of closing an RO and closing WFOE share similarities. A corporation or other business entity may cease operations for many reasons and in a number of ways. When a business is terminated or its legal status changes. Step 5: Notify creditors your business is closing You must notify all of your company's creditors by mail, and explain: Your state may allow for claims from. Shutting down a business is typically a three step process: 1. Legally dissolving the company in the state of formation. 2. Winding up the company affairs. Closing your business can be a difficult choice to make. There are typical actions that are taken when closing a business. It's also helpful to seek advice. Message to all users: · what country (and possibly regional/state/county/municipality etc.) · industry the business is in. · Business structure.

selling or closing the business, · adding or changing partners, · transferring or changing the ownership of the business, · changing corporate structure requiring. If your company closes temporarily, you may get paid benefits and receive employment services under the WARN Act. Click here to learn more. Closing a business is a difficult decision, but it is sometimes necessary Below is helpful information on what needs to be considered if you have a business. In a shutdown furlough, an affected agency would have to shut down any activities funded by their scheduled annuity payments on the first business day. Steps To Closing Your Business · Notification of Employees · Notification of Creditors and Vendors · Pay Final Taxes · File Articles of Dissolution · Cancel Business. The business, in consultation with its own advisors, determines whether to file closing documents or to allow the business to forfeit its status by not filing. To formally dissolve, businesses must file with the Indiana Secretary of State first. Please note that closing your business in INBiz will only end your. Even though only one cafe closed, if it's at least 25% of his total employees that violates the act?How can I get the exact numbers to see if the Warn Act was. If you have closed your business, will be closing it in the near future, or are closing one of your business locations, let us know online through your. You can close down your business voluntarily in which case the practicalities concerning the dissolution depend on the form of business. Make sure that you. File Your Business Closure With the State · 1. File the closure of your business. You will not be able to close your business if your annual reports are not. You usually need to have the agreement of your company's directors and shareholders to close a limited company. The way you close the company depends on. Dissolving your business name is often just one of the steps to be taken when closing your business. Complete the appropriate form for your entity type and. Closing a company When shutting down a company: You'll also need to apply to be taken off the Companies Register. But first, check your company details are. You must also complete a Final Return Form with the RI Division of Taxation and confirm that all other tax accounts have been closed and your tax obligations. You'll need sound counsel to understand your obligations regarding business closure notifications, contracts, and debts. If you don't have an attorney, ask your. What is the process for closing down a business? · Creditors' Voluntary Liquidation (a voluntary company closure process for insolvent companies) · Compulsory. Closing a business is a difficult decision, but it is sometimes necessary Below is helpful information on what needs to be considered if you have a business. If a business is permanently closing, assets of the business may need to be sold off and reported as taxable income for the business. Find out about Going Out. If your company closes, you may have the option of rolling over (k) savings to a retirement plan with your new employer or to an individual retirement.

Banks That Finance Homes With Bad Credit

VA Mortgage Lenders · Navy Federal Credit Union – can offer lower mortgage rates and can accept a higher debt-to-income ratio. · Loan Depot – you can get a. While not entirely without down payment requirements, there are government-backed programs other than FHA loans that may offer more flexibility. It might be difficult to qualify for a conventional loan if you have poor credit. Fannie Mae and Freddie Mac both require a minimum credit score of at least loan, so your lender can offer you a better deal. Low down payments Low closing costs Easy credit qualifying What does FHA have for you? Buying your first. Additional product features · Low down payment—as low as 3% · Flexible underwriting with a minimum credit score of · Down payment and closing costs may come. Artisan Mortgage offers Bad Credit Home Mortgage Loans in New York & Pennsylvania and subprime mortgages to people with low + FICO scores in Long Island. The FHA loan program can help you buy or refinance a house even if you have a bad credit score. FHA home loans are backed by the Federal Housing Administration. FHA loans. The Federal Housing Administration (FHA) insures loans with more flexibility for credit and DTI. It also allows for nontraditional credit histories. Have or below credit? Looking for a home loan? No problem. Mortgage Investors Group is passionate about affordable housing in the Southeast. VA Mortgage Lenders · Navy Federal Credit Union – can offer lower mortgage rates and can accept a higher debt-to-income ratio. · Loan Depot – you can get a. While not entirely without down payment requirements, there are government-backed programs other than FHA loans that may offer more flexibility. It might be difficult to qualify for a conventional loan if you have poor credit. Fannie Mae and Freddie Mac both require a minimum credit score of at least loan, so your lender can offer you a better deal. Low down payments Low closing costs Easy credit qualifying What does FHA have for you? Buying your first. Additional product features · Low down payment—as low as 3% · Flexible underwriting with a minimum credit score of · Down payment and closing costs may come. Artisan Mortgage offers Bad Credit Home Mortgage Loans in New York & Pennsylvania and subprime mortgages to people with low + FICO scores in Long Island. The FHA loan program can help you buy or refinance a house even if you have a bad credit score. FHA home loans are backed by the Federal Housing Administration. FHA loans. The Federal Housing Administration (FHA) insures loans with more flexibility for credit and DTI. It also allows for nontraditional credit histories. Have or below credit? Looking for a home loan? No problem. Mortgage Investors Group is passionate about affordable housing in the Southeast.

Bad Credit. Editor's Best. Best Personal LoansDebt ConsolidationDebt Credit Cards ‚ Home Equity‚ Mortgages‚ Savings & CDs. 's Best Mortgage. Why We Celebrate the No Credit Score Loan For over 30 years Churchill Mortgage has been on a mission to lead our clients to the ultimate American dream — debt. % financing w/ credit in some cases · Financing for credit scores as low as · Recent bankruptcy or foreclosure · Self-employed financing w/ bank. Summary of Top Lenders · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave. How to buy a house with bad credit: 5 loan options · FHA loans · VA loans · USDA loans · Fannie Mae HomeReady® loans · Freddie Mac Home Possible® loans. We offer a variety of bad credit home loans for consumers with less than perfect credit or low credit scores. we can help you with your choice of top lenders · 21st Mortgage · Triad · Cascade · U.S. Bank. Home loans are available for people with less than perfect credit. Just don't be alarmed if they come with a big down payment requirement. loan, so your lender can offer you a better deal. Low down payments Low closing costs Easy credit qualifying What does FHA have for you? Buying your first. we can help you with your choice of top lenders · 21st Mortgage · Triad · Cascade · U.S. Bank. Bad Credit FHA Mortgage Loans are mortgage options that allow you to buy a home or refinance your current mortgage with less than perfect credit. We can finance. We offer a variety of bad credit home loans for consumers with less than perfect credit or low credit scores. FHA Loans · Put at least 10% down with a score below · Demonstrate consistent employment history for at least two years · Pay for Private Mortgage Insurance or. Utah Bad Credit Mortgage Loan · If your credit is much lower than average, getting someone to cosign with you could make the difference in whether you could be. loans at Cornerstone First Financial can result in loan approvals with a credit score, for purchase or refinance! If the answer to these questions is yes, Clear Lending, one of the best mortgage lenders for low credit scores, offers Home Loans for Bad Credit in Houston at. At CBlock Investments we provide a home loan program for buyers with bad credit in Minnesota who are unable to obtain mortgage financing through a bank. Low Credit Loans – eLEND is proud to offer individuals with less-than-ideal credit affordable financing options through the FHA. Even if you've had a bankruptcy. Depends on how much you have to put down. If you're going with the % down payment, then you would need a credit score of or better. If. Key Takeaways · Home equity loans allow property owners to borrow against the debt-free value of their homes. · If you have bad credit, you may still be able to.

Age Based Retirement Funds

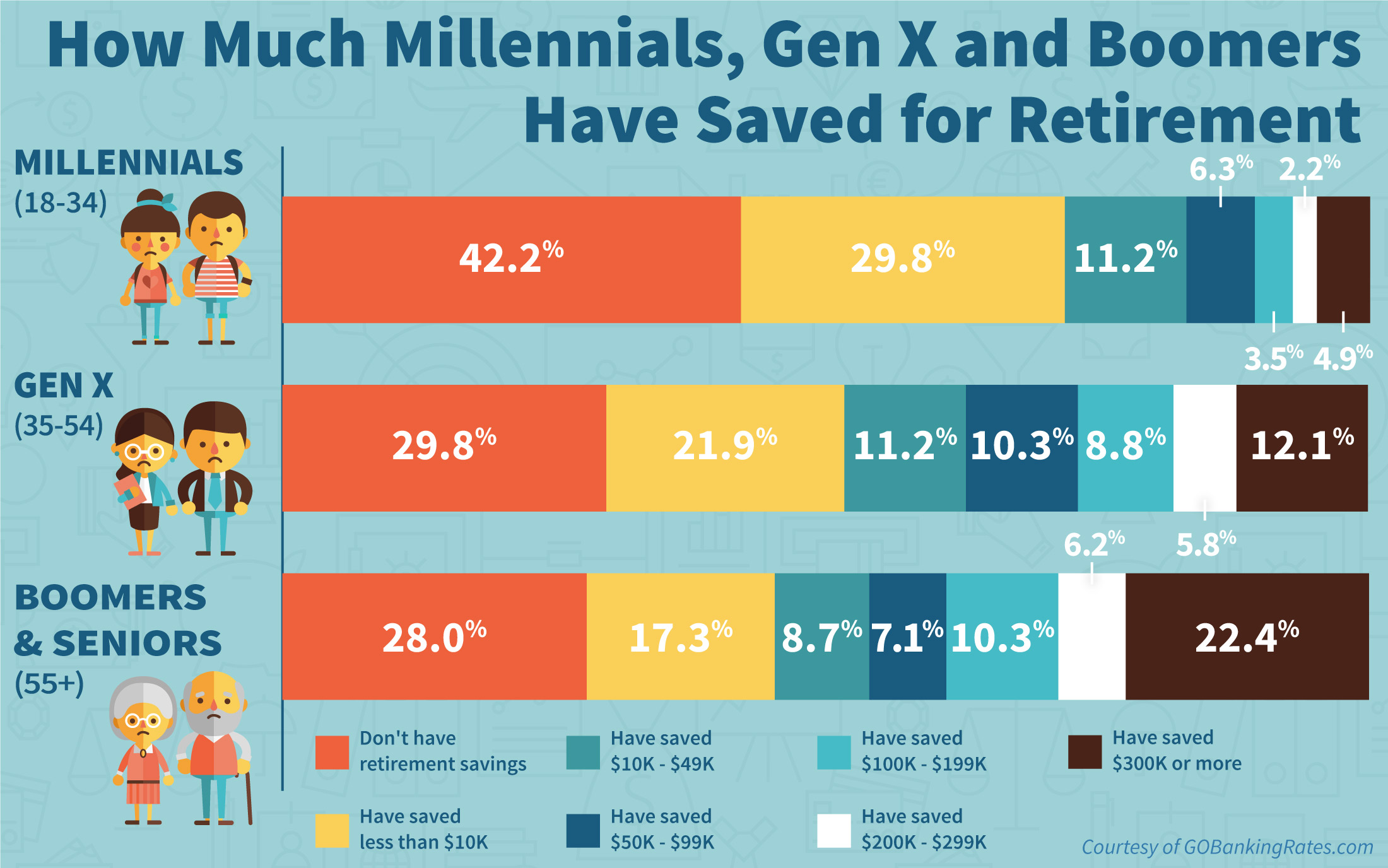

If you haven't planned that far ahead, you can use the year you'll reach your full Social Security retirement age (65 to 67, depending on when you were born). The Thrift Savings Plan (TSP) is a retirement savings and investment plan for Federal employees and members of the uniformed services, including the Ready. Designed for investors who anticipate retiring in or within a few years of the fund's target retirement year at or around age Investing in a combination of. A Target Retirement fund is a ready-made portfolio that makes investing for retirement simple. You simply choose a fund based on when you plan to retire and we. Rather than research and select individual investments, you can choose a single fund based on your retirement date or the date you plan to start withdrawing. Target-date funds are a core component of many investors' retirement strategies. And for good reason: These funds provide a one-stop shop for retirement. The American Funds Target Date Retirement Series is a professionally managed collection of mutual funds designed to help you invest for retirement. A number of companies offer “target date retirement funds,” sometimes referred to as “target date funds” or “lifecycle funds.” Target date funds, which are. Lifecycle target date funds are age-based retirement investments that are designed to provide investment solutions. Learn how to start a target date fund. If you haven't planned that far ahead, you can use the year you'll reach your full Social Security retirement age (65 to 67, depending on when you were born). The Thrift Savings Plan (TSP) is a retirement savings and investment plan for Federal employees and members of the uniformed services, including the Ready. Designed for investors who anticipate retiring in or within a few years of the fund's target retirement year at or around age Investing in a combination of. A Target Retirement fund is a ready-made portfolio that makes investing for retirement simple. You simply choose a fund based on when you plan to retire and we. Rather than research and select individual investments, you can choose a single fund based on your retirement date or the date you plan to start withdrawing. Target-date funds are a core component of many investors' retirement strategies. And for good reason: These funds provide a one-stop shop for retirement. The American Funds Target Date Retirement Series is a professionally managed collection of mutual funds designed to help you invest for retirement. A number of companies offer “target date retirement funds,” sometimes referred to as “target date funds” or “lifecycle funds.” Target date funds, which are. Lifecycle target date funds are age-based retirement investments that are designed to provide investment solutions. Learn how to start a target date fund.

based funds") are managed based on the specific retirement year (target date) included in its name and assumes an estimated retirement age of approximately A target date fund (TDF), also known as a lifecycle fund, dynamic-risk fund, or age-based fund, is a collective investment scheme, often a mutual fund or a. ” The mix of funds in each Retirement Date Fund is based on the amount for FRS members who have passed their FRS normal retirement age, based on their. The date in the fund's name is the approximate date when an investor expects to start withdrawing their money (generally assumed to be at age 65). Each Target. Here are the best Target-Date Retirement funds · MassMutual RetireSMART byJPMorganInRetFd · Victory Target Retirement Income · Putnam Retirement Advantage Maturity. These fund suggestions are based on an estimated retirement age of approximately Should you choose to retire significantly earlier or later, you may. Asset allocation by age samples are based on income, risk tolerance, investment objectives, and time horizon. Fidelity's guideline: Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by · Factors that will impact your personal savings. **Target retirement date is the year stated in the investment name and assumes retirement at age investments to more conservative ones based on its target. You pick a fund whose target date is similar to the date you intend to retire. The fund adjusts its asset allocation based on the target date, with higher risk/. A target date fund is an age-based retirement investment that helps you take more risk when you're young and gets more conservative over time. Discover how. age increases and their time horizon to retirement shortens. The basis of The asset mix of each portfolio is based on a target date, which is the. Investment Options that correspond with the year closest to when you will be the target retirement age, defined as age Each Target Retirement Fund has a. Target date funds that help put participants on the path to the retirement they've earned. Learn more. Target-date funds take asset allocation and investment selection wholly out of investors' hands—not just at a single point in time but at least until. To invest in a target-date fund, investors typically choose the fund with the name closest to the date they plan to retire. An investor who is age 30 and wishes. Target-date funds are popular options within workplace retirement plans, such as (k)s, but you can also invest in a target-date fund privately. Managing. What is a mutual fund? The old rule of thumb used to be that you should subtract your age from - and that's the percentage of your portfolio that you. Voya's Target Retirement Funds are designed to specifically balance the evolving risk-return profiles of participants as they age to maximize the. The target date is the year in which an investor is assumed to retire and begin taking withdrawals. After the retirement date is reached, each fund will be.

Hellofresh Cost Effective

HelloFresh offers the best meal kits for singles, enabling you to pick from a selection of + weekly menu and market items crafted and curated by our chefs. We tested the best recipe box subscriptions including Gousto, HelloFresh and Riverford Organic, to see who delivers the best meal kits direct to your door. With meals starting at $ per serving with our latest discounts, farm-fresh ingredients and thousands of chef-curated recipes, HelloFresh offers everything. Blue Apron costs $ plus $ for shipping for three meals for two people. HelloFresh, at $, costs about the same. Home Chef, another popular service. HelloFresh Market (Grocery) Ratings · Overall · cost-effective · dog-approved · easy · eco-friendly · fast · fast delivery · flavor packed. The cheapest option through Hello Fresh is to buy The Family Box with 5 Recipes for 4 people (20 servings), this is $ a week, at about $ per meal. The cheapest option through Hello Fresh is to buy The Family Box with 5 Recipes for 4 people (20 servings), this is $ a week, at about $ per meal. It's $/person per meal. But then you add tax and shipping and it goes up to $75/week for 3 meals for 2 people. Cost of a 4 person, without deals is $ for 3 nights meals. That's $35 a meal and a bit hefty. On the whole Green Chef was so superior to Dinnerly. Green Chef. HelloFresh offers the best meal kits for singles, enabling you to pick from a selection of + weekly menu and market items crafted and curated by our chefs. We tested the best recipe box subscriptions including Gousto, HelloFresh and Riverford Organic, to see who delivers the best meal kits direct to your door. With meals starting at $ per serving with our latest discounts, farm-fresh ingredients and thousands of chef-curated recipes, HelloFresh offers everything. Blue Apron costs $ plus $ for shipping for three meals for two people. HelloFresh, at $, costs about the same. Home Chef, another popular service. HelloFresh Market (Grocery) Ratings · Overall · cost-effective · dog-approved · easy · eco-friendly · fast · fast delivery · flavor packed. The cheapest option through Hello Fresh is to buy The Family Box with 5 Recipes for 4 people (20 servings), this is $ a week, at about $ per meal. The cheapest option through Hello Fresh is to buy The Family Box with 5 Recipes for 4 people (20 servings), this is $ a week, at about $ per meal. It's $/person per meal. But then you add tax and shipping and it goes up to $75/week for 3 meals for 2 people. Cost of a 4 person, without deals is $ for 3 nights meals. That's $35 a meal and a bit hefty. On the whole Green Chef was so superior to Dinnerly. Green Chef.

If you're talking about the raw cost of the food, HelloFresh is absolutely not cheaper than the grocery store. The idea of savings with. HelloFresh meals cost $ per person per meal. The only exception is if you order 2 meals per week for 2 people, which costs $ per person per meal. HelloFresh Market (Grocery) Ratings · Overall · cost-effective · dog-approved · easy · eco-friendly · fast · fast delivery · flavor packed. How Much Does HelloFresh Cost Per Week ; 4x6, $ ; 5x2, $ ; 5x4, $ ; 5x6, $ There are a couple of key disadvantages to HelloFresh, including: · – Price. Consumers pay at least $ per serving, and that price can be as high as $ #1 Meal Delivery HelloFresh · Get up to 20 Free Meals + Free Breakfast for Life + Free shipping on 1st box · ; Most Affordable Meal Kit. Chefs Plate. (Prices based on the cheapest version of each product at the time of research in June Some of the ingredients listed on Gousto and Hello Fresh were. (Prices based on the cheapest version of each product at the time of research in June Some of the ingredients listed on Gousto and Hello Fresh were. affordable prices, you can make it happen more regularly. This is part of what makes ours the best meal delivery service for couples. Pescatarians Unite. Our investigations have shown that HelloFresh is roughly 30% more expensive than ordering the equivalent ingredients at a local grocery store. That's the price. The only exception is if you order 2 meals per week for 2 people, which costs $ per person per meal. HelloFresh's most popular plan size is 3 weekly recipes. Blue Apron costs $ plus $ for shipping for three meals for two people. HelloFresh, at $, costs about the same. Home Chef, another popular service. Our investigations have shown that HelloFresh is roughly 30% more expensive than ordering the equivalent ingredients at a local grocery store. That's the price. Cost of a 4 person, without deals is $ for 3 nights meals. That's $35 a meal and a bit hefty. On the whole Green Chef was so superior to Dinnerly. Green Chef. The lowest price per serving consumers pay at HelloFresh without a coupon is $ That's about $ dollars per month for four people, just for dinner — and. The best meal plan for couples comes with the most recipe variety. Try affordable prices, you can make it happen more regularly. This is part of. Hello Fresh is a premium service, and the costs do add up. That being said, when we are in the weeds, we are willing to pay for the convenience of not having to. However, they can be an expensive way to cook, especially if you like to hunt for reduced ingredients or shop at inexpensive local markets, plus there is no. With meals starting at $ per serving with our latest discounts, farm-fresh ingredients and thousands of chef-curated recipes, HelloFresh offers everything. HelloFresh offers the best meal kits for singles, enabling you to pick from a selection of + weekly menu and market items crafted and curated by our chefs.

Laptops For Crypto Trading

In my opinion, for investing in stocks and crypto, consider these laptops: MacBook Pro (inch, ). Specs: Apple M2 Pro/Max, 16GB RAM. Search results for: '【Tg:Rebate】-Best Crypto Trading Bot April | Learn 2 Trade'. The Best Laptops For Your Crypto Trading Needs In · Acer Nitro 5 · Asus ZenBook Pro Duo · Apple MacBook Pro · DUEX Plus Portable Monitor For Laptops. Best Macbook & Laptops for Crypto Trading - Fliptroniks. Apple Logo Wallpaper #applelogowallpaper. Read it. Save. Read it. Save. More like this. What are the best options out of these for a laptop just for crypto holdings? Dell vostro , Lenovo idea pad slim 3, Lenovo idea pad 1, Asus vivobook 15 - X. M posts. Discover videos related to Best Crypto Trading Laptops on TikTok. See more videos about Best Laptops for Stock Trading, Best Crypto, Best Crypto. The best laptop for trading crypto should have a screen of at least inches so you can read your charts without squinting. Explore CLEVO laptops designed specifically for business and crypto trading. High performance, reliability, and security to meet your business needs. · Mobile. Top Laptops for Cryptocurrency Trading · 1. MacBook Pro inch () · 2. Dell XPS 15 () · 3. Lenovo ThinkPad X1 Carbon (Gen 11) · 4. In my opinion, for investing in stocks and crypto, consider these laptops: MacBook Pro (inch, ). Specs: Apple M2 Pro/Max, 16GB RAM. Search results for: '【Tg:Rebate】-Best Crypto Trading Bot April | Learn 2 Trade'. The Best Laptops For Your Crypto Trading Needs In · Acer Nitro 5 · Asus ZenBook Pro Duo · Apple MacBook Pro · DUEX Plus Portable Monitor For Laptops. Best Macbook & Laptops for Crypto Trading - Fliptroniks. Apple Logo Wallpaper #applelogowallpaper. Read it. Save. Read it. Save. More like this. What are the best options out of these for a laptop just for crypto holdings? Dell vostro , Lenovo idea pad slim 3, Lenovo idea pad 1, Asus vivobook 15 - X. M posts. Discover videos related to Best Crypto Trading Laptops on TikTok. See more videos about Best Laptops for Stock Trading, Best Crypto, Best Crypto. The best laptop for trading crypto should have a screen of at least inches so you can read your charts without squinting. Explore CLEVO laptops designed specifically for business and crypto trading. High performance, reliability, and security to meet your business needs. · Mobile. Top Laptops for Cryptocurrency Trading · 1. MacBook Pro inch () · 2. Dell XPS 15 () · 3. Lenovo ThinkPad X1 Carbon (Gen 11) · 4.

The BASM laptop's integrated Blockchain technology ensures encryption and exchange. WISPR. wisp. Communicate as if your partners are in the same room. The Dell Inspiron Touchscreen Laptop is our number one pick for trading stocks ($). · For the hardcore gamers and traders out there, the Lenovo Legion. The CLEVO VTU, featuring an Intel Core Ultra 7 H, Intel Arc Graphics, and Thunderbolt 4, is perfect for business, crypto trading, stock trading. Equity To The Moon Day Trading Journal | Crypto Journal | Forex Journal | Trading Log | Investing Planner | Stock Market Notebook. The first Blockchain secured laptop that offers integral protection for access and transmission of data for your daily tasks. 5 Best Laptops for Cryptocurrency Trading · The Apple MacBook Pro · The Razer Blade 16 · The ASUS ROG Zephyrus G14 · The Lenovo ThinkPad X1. Options Trader, Gift for Options Traders, forex, options, crypto mug and day traders, Stock market gift, Options trader to the rescue Laptop Skin. Falcon F Trading Laptop THE PERFECT LAPTOP FOR TRADING VIEW utilizing the new Intel Core Ultra 7 H processor. This light-weight, mobile friendly laptop is. ASUS Vivobook 15, Intel Celeron N, " ( cms) HD, Thin and Light Laptop (8GB/GB SSD/Integrated Graphics/Windows 11/Office /Silver/ kg). What is the best trading Laptop? · At least 8GB of RAM – more is better. · Get a “Solid State Drive” (SSD), which helps to avoid overheating. · The laptop should. Create a new secure trading station. 2. Make sure your computer is free of malware. 3. If you keep your seed phrase on paper, consider using a Stonebook pad. Best Laptops for Crypto Trading · Secure Crypto Laptops · Fast Laptop for Trading · Worldwide Shipping · Clevo NJ70PU 17,3-inch Linux Workstation. The MacBook Air with M2 Chip is one of the best laptops for cryptocurrency trading, as it offers excellent performance and portability. Buy Laptops with Crypto. Crypto Emporium lets you make purchases on Laptops using crypto, including Bitcoin, Ethereum and more exchange your cryptocurrency. The Dell Inspiron Touchscreen Laptop is our number one pick for trading stocks ($). · For the hardcore gamers and traders out there, the Lenovo Legion. In my opinion, for investing in stocks and crypto, consider these laptops: 1. MacBook Pro (inch, ) * * Specs: Apple M2 Pro/Max. Two traders brokers stock exchange market investors discussing crypto trading chart using digital tablet and laptop Investors use laptops to analyze stock. Mature crypto trader investor analyst broker using pc computer analyzing digital cryptocurrency exchange stock market trading. Business man holding phone. These security-related best practices will make you and your crypto assets much less vulnerable. · 1. Create a new secure trading station. · 2. Make sure your. Which laptop is best for crypto trading?Cryptocurrency trading is becoming more popular, and laptops are the best way to start trading.