googlepage.ru Overview

Overview

What Is Personal Loan Used For

A personal loan may give you the chance to secure a lower interest rate and a more manageable monthly payment than what you owe on your credit cards. As we. With a personal loan, you can use the funds for almost anything, from paying off high-interest debt to funding a large purchase. But your loan agreement may. You can use a personal loan to knock out debt, finance a big purchases or plan the wedding of your dreams — but make sure you factor in the costs. · 1. Paying. Personal loans are money you borrow from an entity, usually a bank or a different financial institution, carrying a fixed repayment schedule and consistent. What Are Personal Loans Used For? One of the most appealing things about a personal loan is that you can use the funds for just about anything. Whether you want. Apply for a personal loan without ever leaving your couch. U.S. Bank customers could receive funds within hours. Check your rate & apply. Personal loans can be used for just about anything. Generally, the only time you'll need to specify a purpose for your personal loan is if you're planning debt. Personal loans are often used for debt consolidation, so you may be able to pay down your debt at a fixed rate. A personal loan can also help finance a large. However, there are also some expenses a personal loan usually can't be used to cover. It's better to make sure you aren't breaching any loan terms; using a loan. A personal loan may give you the chance to secure a lower interest rate and a more manageable monthly payment than what you owe on your credit cards. As we. With a personal loan, you can use the funds for almost anything, from paying off high-interest debt to funding a large purchase. But your loan agreement may. You can use a personal loan to knock out debt, finance a big purchases or plan the wedding of your dreams — but make sure you factor in the costs. · 1. Paying. Personal loans are money you borrow from an entity, usually a bank or a different financial institution, carrying a fixed repayment schedule and consistent. What Are Personal Loans Used For? One of the most appealing things about a personal loan is that you can use the funds for just about anything. Whether you want. Apply for a personal loan without ever leaving your couch. U.S. Bank customers could receive funds within hours. Check your rate & apply. Personal loans can be used for just about anything. Generally, the only time you'll need to specify a purpose for your personal loan is if you're planning debt. Personal loans are often used for debt consolidation, so you may be able to pay down your debt at a fixed rate. A personal loan can also help finance a large. However, there are also some expenses a personal loan usually can't be used to cover. It's better to make sure you aren't breaching any loan terms; using a loan.

Personal Loan Uses · Debt Consolidation: By combining higher interest rate loans and credit card balances into one lump sum, you can streamline your monthly. Personal Loan Uses · Debt Consolidation: By combining higher interest rate loans and credit card balances into one lump sum, you can streamline your monthly. Personal loans are considered unsecured loans because they do not require some form of collateral, such as a down payment for a mortgage or a car when taking. In need of a resource to help pay for small projects? Check out ProFed's personal loans. Quick, short-term, multi-purpose financial solutions available to. A personal loan is typically an unsecured loan, which means that the lender does not require collateral—a home or a car, for example—to borrow money. · Some. By applying for HDFC Bank Personal Loan, you are at the liberty to use this money to pay for things such as tuition fees, books, clothes etc. A Personal Loan. SoFi Personal Loans can be used for any lawful personal, family, or household purposes and may not be used for post-secondary education expenses. Minimum loan. A Discover personal loan is intended for personal use and cannot be used to pay for post-secondary education, to pay off a secured loan, or to directly pay off. How do they work? Well, for example, when you take out a mortgage, the home is usually used as collateral. If you miss too many mortgage payments, the financial. Once approved for a personal loan, the money will be deposited into your account and you may use it for any expense, large or small, including: Refinancing. A personal loan allows you to borrow a lump sum of money to pay for a variety of expenses and then repay those funds in regular payments, or installments, over. A personal loan offers another way to borrow money to buy a used car. You might not get quite as good of an interest rate, but the difference might not be so. Did you know that personal loans are one of the most flexible, affordable options for borrowing funds? In addition to offering lower interest rates than. You can use the funds from this loan for any legitimate financial need. Like any other loan, you must repay it accordance to the agreed terms with the bank. Personal loans provide you fast, flexible access to funds that can be used for many major life events, expenses or consolidating debt, all with one fixed. How do personal loans work? · Are unsecured, meaning they are not backed by collateral like your car or house. · Come in amounts ranging from $1,$, The borrowed money can be used to consolidate debt, pay for a home remodel or repairs, or to cover surprise expenses and major life events. Personal loans. Personal loans are unsecured and used for general purposes. This means that you can use one of our personal loans for everything from consolidating your. A personal loan is a line of credit that can be used at your discretion. People commonly use them to cover home repairs, medical bills and other unexpected one-.

Life Annuity Pension

A guaranteed lifetime annuity is a financial product that promises to pay its owner income on a regular basis for the rest of their life. The ongoing shift from defined benefit (DB) pensions plans to defined contribution (DC) plans requires employees to take on more of the responsibility to ensure. An annuity is a written contract typically between you and a life insurance company in which the insurance company makes a series of regularly spaced payments. A section 32 buyout policy will usually provide a lifetime annuity because the member will be able to transfer it to another insurance company to pay the income. A single life pension annuity is the most common type of pension annuity. With a single life pension annuity, an individual will pay a lump sum to an insurance. A pension annuity is a product that converts your pension pot into guaranteed regular income for the rest of your life, no matter how long you live. An annuity is a contract that requires regular payments for more than one full year to the person entitled to receive the payments (annuitant). Before you begin to receive your monthly pension benefit from PBGC, you have an important decision to make: A straight-life annuity provides a fixed monthly. An immediate annuity lets you immediately turn a lump sum of money into a guaranteed stream of income. A guaranteed lifetime annuity is a financial product that promises to pay its owner income on a regular basis for the rest of their life. The ongoing shift from defined benefit (DB) pensions plans to defined contribution (DC) plans requires employees to take on more of the responsibility to ensure. An annuity is a written contract typically between you and a life insurance company in which the insurance company makes a series of regularly spaced payments. A section 32 buyout policy will usually provide a lifetime annuity because the member will be able to transfer it to another insurance company to pay the income. A single life pension annuity is the most common type of pension annuity. With a single life pension annuity, an individual will pay a lump sum to an insurance. A pension annuity is a product that converts your pension pot into guaranteed regular income for the rest of your life, no matter how long you live. An annuity is a contract that requires regular payments for more than one full year to the person entitled to receive the payments (annuitant). Before you begin to receive your monthly pension benefit from PBGC, you have an important decision to make: A straight-life annuity provides a fixed monthly. An immediate annuity lets you immediately turn a lump sum of money into a guaranteed stream of income.

Income annuities can help your savings last by turning them into a stream of guaranteed payments, which act like a pension in some ways. You receive payments that may vary in amount for a specified length of time or for life. The amounts you receive may depend upon such variables as profits. A pension is an employer-provided retirement plan offering employees a predetermined monthly income in retirement based on salary and years of service. On the. An annuity terminates on the day the annuitant dies or the date of other terminating events provided by title 5, US Code, Section (c), et seq. A life annuity is an annuity, or series of payments at fixed intervals, paid while the purchaser (or annuitant) is alive. Pacific Life offers a variety of annuities designed to help grow, protect, and manage retirement savings turning it into steady, reliable lifetime income. When you retire, your pension fund provides monthly payments for the rest of your life. Thus, the pension acts as a steady paycheck in retirement. Your monthly. For most people, annuities are an additional way to plan for retirement, along with an IRA, (k), or pension. They can help simplify the task of turning a. When you retire, annuities are the only option besides social security and pensions that are capable of providing income for as long as you live. Discover. A single-life annuity (SLA) is a type of annuity that pays out to the owner for their lifetime. The payout amount will depend on how much money was invested and. A life annuity provides guaranteed income payments for as long as you live. A joint life annuity provides payments as long as you or your spouse/partner lives. It will pay you a guaranteed income for the rest of your life. · It might be suitable if you're generally risk adverse and don't want your pension pot to be. The main difference lies in the nature of each product: a pension plan is a saving and investment product, and a retirement annuity is an insurance contract. When you opt for a monthly annuity in retirement, you have two choices: to get payments that last for the life of just one person - you - or payments that. An annuity, also known as a lifetime or fixed-term pension, gives you a guaranteed income for a number of years. Or the rest of your life. A purchased life annuity is an annuity that you buy with money that doesn't come from a pension pot. So you could invest money from a house sale, your savings. Yep. A pension plan is an annuity payment that guarantees a lifetime income stream. Now, it depends on your employer and how they've set things up. Income annuities can provide the confidence that you will have guaranteed retirement income for life or a set period of time. Annuity Payments. The most common way to receive your pension is through a life annuity. This means you'll receive payments periodically for the rest of your. An annuity plan is a financial product that provides you guaranteed regular payments for the rest of your life after making a lump sum investment.

Coin Market View

Explore top cryptocurrencies with googlepage.ru, where you can find real-time price, coins market cap, price charts, historical data and currency converter. Crypto trading is a great way to get involved in the blockchain revolution. Crypto markets move fast. Let us keep you up to date with our detailed crypto news. Top cryptocurrency prices and charts, listed by market capitalization. Free access to current and historic data for Bitcoin and thousands of altcoins. Baehr emphasizes that for the broader crypto market to thrive, bitcoin For more expert insight and the latest market action, click here to watch this full. Bitcoin trading volumes have increased meaningfully during the pandemic. In January , Cointelegraph reported that volume in the Bitcoin market doubled. Crypto prices · The global cryptocurrency market cap today is $T, a % change from 24 hours ago. · Get cryptocurrency prices for 4, assets. Visualize the Crypto Market with COIN's Comprehensive Heatmap. Discover Current Cryptocurrency Prices. Explore Market Capitalizations of Different Coins. Coinranking gives you price data of all cryptocurrencies. Here, you can check for real-time prices, market caps and historical price data. Fastest live cryptocurrency price & portfolio tracker with historical charts, latest coin markets from crypto exchanges, volume, liquidity, orderbooks and. Explore top cryptocurrencies with googlepage.ru, where you can find real-time price, coins market cap, price charts, historical data and currency converter. Crypto trading is a great way to get involved in the blockchain revolution. Crypto markets move fast. Let us keep you up to date with our detailed crypto news. Top cryptocurrency prices and charts, listed by market capitalization. Free access to current and historic data for Bitcoin and thousands of altcoins. Baehr emphasizes that for the broader crypto market to thrive, bitcoin For more expert insight and the latest market action, click here to watch this full. Bitcoin trading volumes have increased meaningfully during the pandemic. In January , Cointelegraph reported that volume in the Bitcoin market doubled. Crypto prices · The global cryptocurrency market cap today is $T, a % change from 24 hours ago. · Get cryptocurrency prices for 4, assets. Visualize the Crypto Market with COIN's Comprehensive Heatmap. Discover Current Cryptocurrency Prices. Explore Market Capitalizations of Different Coins. Coinranking gives you price data of all cryptocurrencies. Here, you can check for real-time prices, market caps and historical price data. Fastest live cryptocurrency price & portfolio tracker with historical charts, latest coin markets from crypto exchanges, volume, liquidity, orderbooks and.

View the full list of all active cryptocurrencies.

Understand the market cap potential of your favorite alt coins. Cryptocurrency News · Bitcoin continues to fall as crypto-market sentiment shifts into 'extreme fear' · Most big cryptocurrencies fall on Dogecoin, Chainlink. Empower your decision-making with thousands of metrics and indicators for Bitcoin, Ethereum, DeFi, stablecoins, top cryptocurrencies, and derivatives markets. The crypto global market cap is T, a % decrease over the last day. Tech analysis of the biggest cryptos. View All. Coin. Price. Last 7 Days. Get a crypto market overview: Bitcoin and altcoin prices, latest news, coin market cap, charts, and much more. BTCUSD | A complete CoinDesk Bitcoin Price Index (XBX) cryptocurrency overview by MarketWatch. View the latest cryptocurrency news, crypto prices and market. Real-time cryptocurrency market cap rankings, trading charts, and more. Keep track of the latest crypto prices. Get the latest crypto market information on Bitcoin, Ethereum, and other top cryptocurrencies, all in one place. Binance cryptocurrency market - The easiest way to know the last prices, coin market Please view our General Risk Warning for more information. Show More. Enjoy greater capital efficiency in crypto-trading through better price discovery in a transparent and liquid futures market. Get enhanced pricing information. Check the overall crypto market performance with our crypto tracker app. View the health of your crypto portfolio tracker coin stats and blockchain or metaverse. View top cryptocurrency prices live, crypto charts, market cap, and trading volume. Discover today's new and trending coins, top crypto gainers and losers. Check the overall crypto market performance and know where the industry stands today with our crypto tracker app. View the health and activity of your. CoinCodex provides all the data you need to stay informed about cryptocurrencies. You can find cryptocurrency charts for more than [googlepage.ru_coins] coins, and. The market cap of any given cryptocurrency is simple to calculate. We take the price of a single unit of cryptocurrency and multiply it by the amount of units. View crypto prices and charts, including Bitcoin, Ethereum, XRP, and more. Earn free crypto. Market highlights including top gainer, highest volume. Live streaming prices and the market capitalization of all cryptocurrencies such as bitcoin and Ethereum. View and analyze over cryptocurrencies from. Top Cryptocurrency by Market Capitalization. Total Market Cap: $1,,,, Next View all. Name. Price(USD). Chg 24h. googlepage.ru(USD). Vol 24h. Global Cryptocurrency Market Cap Charts. The global cryptocurrency market cap today is $ Trillion, a % change in the last 24 hours and % change. CoinCodex provides all the data you need to stay informed about cryptocurrencies. You can find cryptocurrency charts for more than [googlepage.ru_coins] coins, and.

Best Swim Trunks For Guys

Products · Solid Square Leg. Move to Wishlist Save to Wishlist · Shoreline Square Leg. Move to Wishlist Save to Wishlist · Easy Long Sleeve Swim Rashguard. Move. Shop men's swim from Faherty for quality crafted swim trunks, and more with modern American heritage styles. The ultimate men's stretch swim trunks. Full-stretch fabric, basket mesh liner & available in 4", " or 7" inseams. inch inseam vintage swim trunks, unlike long baggy board shorts, have combined the retro style with breathable and stretchable material to ensure more. 9 Best Men's Swim Trunks · Speedo Marina Volley Knee Length Swim Trunks · SILKWORLD Men's Quick-Dry Swim Trunks · Hurley One and Only Swim Trunks · Hurley. Look good this summer with men's swim trunks from Bonobos. Shop an amazing selection of men's bathing suits, swim shorts and board shorts. 20% Off Your. We have the best matching his and her swim in multiple styles - ranging from nautical stripes to palms, Positano-ready lemons, animal prints and on. Either way. Our swim trunks are designed to provide both style and comfort, with a range of colors and patterns to suit any taste. Designed specifically for men, these swim trunks provide a comfortable, water-resistant, and anti-chafe fabric barrier for maximum protection and comfort. Products · Solid Square Leg. Move to Wishlist Save to Wishlist · Shoreline Square Leg. Move to Wishlist Save to Wishlist · Easy Long Sleeve Swim Rashguard. Move. Shop men's swim from Faherty for quality crafted swim trunks, and more with modern American heritage styles. The ultimate men's stretch swim trunks. Full-stretch fabric, basket mesh liner & available in 4", " or 7" inseams. inch inseam vintage swim trunks, unlike long baggy board shorts, have combined the retro style with breathable and stretchable material to ensure more. 9 Best Men's Swim Trunks · Speedo Marina Volley Knee Length Swim Trunks · SILKWORLD Men's Quick-Dry Swim Trunks · Hurley One and Only Swim Trunks · Hurley. Look good this summer with men's swim trunks from Bonobos. Shop an amazing selection of men's bathing suits, swim shorts and board shorts. 20% Off Your. We have the best matching his and her swim in multiple styles - ranging from nautical stripes to palms, Positano-ready lemons, animal prints and on. Either way. Our swim trunks are designed to provide both style and comfort, with a range of colors and patterns to suit any taste. Designed specifically for men, these swim trunks provide a comfortable, water-resistant, and anti-chafe fabric barrier for maximum protection and comfort.

Shop men's bathing suits at Lands' End. Free shipping available. View our full men's swimwear collection including men's swim trunks and swim shirts. Days spent by the water require the best swimwear and men's swim trunks. Tailored swim trunks are a luxe upgrade that is equally chic whether you're on land or. Hi-Tide Scallop Board Shorts for Tall Men in Blue Brushstroke. Our picks of the best men's swim trunks reflect a variety of price points, too. Shop on, and enjoy your time in the sun. Discover the best Men's Swim Trunks in Best Sellers. Find the top most popular items in Amazon Clothing, Shoes & Jewelry Best Sellers. 14 Mens Swim Trunks, Bathing Suits & Swimwear - Best Board Shorts for Men Athletic Bikinis, Mens Fashion Summer Shorts, Vacation Swimsuit. Our performance-driven trunks fit great, are super durable and won't chafe where you don't want them to. Our highest performing trunks featuring an enhanced. It depends on the type of swimsuit but polyester-spandex and nylon-spandex blends are the best for durability and comfort for close fitting and. Take the Billy Reid Moore Hybrid Swim Shorts. They look like a standard pair of classic chino shorts — the kind you might wear with a stylish denim shirt from. Men's Swim Trunks · Filter · PatagoniaHydropeak Board Shorts - Men's 18" Outseam · prAnaLa Jolla Lined Swim Shorts - Men's · ChubbiesStretch " Swim Trunks -. Shop The Best Swim Trunks for Men in Enjoy 15% OFF your first order. Located and Shipped from Miami directly to you. Free Returns and Exchanges. Men's Swim ; Black · Reviews ; Green Mini Floral Bayberry Trunk · Reviews ; Red Waves Bayberry Trunk · Reviews ; Mist Seaview · Reviews ; Light. Best men's swim jammers · Speedo Eco Endurance+ Slice Jammers · 2XU Propel Jammer · Funky Trunks Rainbow Web · Zoggs Kongo Mid Jammer · Tenola Male Jammers · Funky. Shop for 4 - 5 Stars Mens Swim Trunks in Mens Swimwear at Walmart and save. Hit the beach in SAXX's men's swim trunks and shorts with quick Best Seller. Best Seller. Front of Betawave 2N1 Swim Board Short Regular in. Men's Swim · 7" Hybrid Short. $94 · 7" Hybrid Short. $94 · 7" Hybrid Short. $94 · 6" Stretch Swim Trunk. Regular price $78 $60 · 6" 4-Way Stretch Swim Trunk. Regular. Swimming trunks are ideal for getting a little more sun while hanging out at the beach or by the pool, while boardshorts are a good choice if you plan to surf. Whether you're swimming or relaxing by the water, you'll love our collection of DXL exclusive brands like Harbor Bay or True Nation and top name brands such as. Shop Best Men's Swim Trunks Swimsuits at DICK'S Sporting Goods. If you find a lower price on Best Men's Swim Trunks Swimsuits somewhere else, we'll match it. Under makes shorts and swimwear that fits the shorter guy properly and lands above the knee. Like all of our products, our shorts and trunks are.

Best Dividend Paying Stocks To Buy Now

High Yield Dividend Stocks, ETFs, Funds ; Haw Par Corporation LimitedHaw Par Limited. HAWPF · $ %. - ; Navient CorporationNavient. NAVI · $ %. Reduce corporate debt, especially if they have high debt levels; Buy back shares to increase the value of each remaining share; Pay shareholders cash dividends. Best Dividend Stocks to Buy & Hold in · 9 best dividend stocks · 1. Lowe's · 2. Realty Income · 3. Chevron · 4. Target · 5. Starbucks · 6. Brookfield. But even after the Fed raised interest rates in 20to stave off inflation, dividend-paying companies continue to sit on near-record high amounts of. 44 minutes ago. The best place to find high dividend paying stocks is REITs. These are real estate companies that are required to pay dividends to their investors. This. US companies with the highest dividend yields ; RILY · D · %, USD ; PETS · D · %, USD ; MED · D · %, USD ; IEP · D · %, USD. Since , the study found that stocks offering the highest level of dividend payouts performed in line overall with those that pay high, but not the very. Chevron (CVX) International Business Machines (IBM) and Altria Group (MO) are some of the most trending Dividend Stocks. High Yield Dividend Stocks, ETFs, Funds ; Haw Par Corporation LimitedHaw Par Limited. HAWPF · $ %. - ; Navient CorporationNavient. NAVI · $ %. Reduce corporate debt, especially if they have high debt levels; Buy back shares to increase the value of each remaining share; Pay shareholders cash dividends. Best Dividend Stocks to Buy & Hold in · 9 best dividend stocks · 1. Lowe's · 2. Realty Income · 3. Chevron · 4. Target · 5. Starbucks · 6. Brookfield. But even after the Fed raised interest rates in 20to stave off inflation, dividend-paying companies continue to sit on near-record high amounts of. 44 minutes ago. The best place to find high dividend paying stocks is REITs. These are real estate companies that are required to pay dividends to their investors. This. US companies with the highest dividend yields ; RILY · D · %, USD ; PETS · D · %, USD ; MED · D · %, USD ; IEP · D · %, USD. Since , the study found that stocks offering the highest level of dividend payouts performed in line overall with those that pay high, but not the very. Chevron (CVX) International Business Machines (IBM) and Altria Group (MO) are some of the most trending Dividend Stocks.

The most comprehensive dividend stock destination on the web. Contains profiles, news, research, data, and ratings for thousands of dividend-paying stocks. The Best Dividend Stock to Buy Now. Oaktree Specialty Lending Corp. (NASDAQ: OCSL) is another BDC that can offer investors the combination of an above-average. To me, 'best' for dividend paying stocks can either mean 'reliable' or 'has strong growth potential. · For reliable dividends, I suggest looking. Reduce corporate debt, especially if they have high debt levels; Buy back shares to increase the value of each remaining share; Pay shareholders cash dividends. There are a couple of reasons that make dividend-paying stocks particularly useful. First, the income they provide can help investors meet liquidity needs. Best dividend stocks · Comcast Corp. (CMCSA) · Bristol-Myers Squibb Co. (BMY) · Altria Group Inc. (MO) · Marathon Petroleum Corp. (MPC) · Diamondback Energy (FANG). Seeks to track the performance of the FTSE® High Dividend Yield Index, which measures the investment return of common stocks of companies characterized by high. You can use Barchart's Top Dividend Stocks list to identify today's stocks paying the highest annual dividend yield. 2 'Strong Buy'-Rated Growth Stocks to. stock trading method popular with day traders. While traditional approaches tend to buy and hold stable dividend-paying stocks to produce a steady income. Long term growth with a dividend, I would be looking at the likes of AVGO, Intel, NEE, AWK, JPM, IBM, XOM. These stocks all have 3% or better. Dividend-paying stocks could potentially pump up total returns from your stock portfolio and generate extra income. Open Trading Account ; Chennai Petro. Add to. Watchlist | Portfolio. ACTIONS. Chennai Petro closes below Day Moving Average of today. · HMA Agro. googlepage.ru is the most powerful dividend-detecting resource available today. It contains the critical, time-sensitive data you need for income. However, if one is really interested, following stock can be invested in — IOCL, Coal India, HPCL, PFC, ONGC, Infosys, BPCL etc — all of them. Best Dividend Stocks ; Verizon Communications Inc. stock logo. VZ. Verizon Communications. $ %, 6, ; Chevron Co. stock logo. CVX. Chevron. $ Stock Screener Stock Ideas Best Dividend Paying Stocks For The Long Term. Dividend Stock Screener: Best Dividend Paying Stocks For The Long Term. A dividend. I think I'm going to buy the BG Global Income Growth fund, do you know of any others? As today's 'good funds' (i.e. funds that have performed best in the past. Description: Kinder Morgan is involved in energy transportation and storage, providing a high dividend yield with growth prospects tied to the. U.S. stocks account for two-thirds of a UBS list of reliable dividend payers, but some of the highest-yielding companies are based overseas. 2 min read. Go to. Companies that pay out a portion of their profits as dividends are known as dividend stocks. This type of stock can serve as a reliable income stream;.

2022 Mercedes Small Suv

Go green with our Mercedes-Benz GLA SUVs. These SUVs have all of the modern conveniences of most SUVs but leave behind a much smaller carbon footprint. The Mercedes-Benz GLC is a compact luxury SUV that seats five people. It's for drivers who don't want or need a larger SUV yet find small sedans lacking. The GLA-class is powered by a turbocharged liter four-cylinder engine that drives the front or all four wheels and makes horsepower. With each Mercedes-Benz SUV trim level, you'll find exceptional power under the hood. The GLA features a horsepower L inline-4 turbo engine while. The GLA is the brand's most cost-effective SUV, so you're bound to find one that fits into your preferred price bracket. In their latest GLA review, Edmunds. IIHS ratings for the Mercedes-Benz GLC 4-door SUV - midsize luxury SUV. Research the Mercedes-Benz GLA at googlepage.ru and find specs, pricing, MPG, safety data, photos, videos, reviews and local inventory. Mercedes-Benz GLC: Price by Trim · GLC SUV – $43, MSRP* · GLC 4MATIC® SUV – $45, MSRP* · AMG® GLC 43 SUV – $59, MSRP*. If you're ready to set off on a new adventure, keep reading our Mercedes-Benz GLC review. This midsize SUV is the perfect mix of comfort and luxury. Go green with our Mercedes-Benz GLA SUVs. These SUVs have all of the modern conveniences of most SUVs but leave behind a much smaller carbon footprint. The Mercedes-Benz GLC is a compact luxury SUV that seats five people. It's for drivers who don't want or need a larger SUV yet find small sedans lacking. The GLA-class is powered by a turbocharged liter four-cylinder engine that drives the front or all four wheels and makes horsepower. With each Mercedes-Benz SUV trim level, you'll find exceptional power under the hood. The GLA features a horsepower L inline-4 turbo engine while. The GLA is the brand's most cost-effective SUV, so you're bound to find one that fits into your preferred price bracket. In their latest GLA review, Edmunds. IIHS ratings for the Mercedes-Benz GLC 4-door SUV - midsize luxury SUV. Research the Mercedes-Benz GLA at googlepage.ru and find specs, pricing, MPG, safety data, photos, videos, reviews and local inventory. Mercedes-Benz GLC: Price by Trim · GLC SUV – $43, MSRP* · GLC 4MATIC® SUV – $45, MSRP* · AMG® GLC 43 SUV – $59, MSRP*. If you're ready to set off on a new adventure, keep reading our Mercedes-Benz GLC review. This midsize SUV is the perfect mix of comfort and luxury.

Room for up to 7. With big ideas in a compact footprint, carbon footprint included, what makes a great all-electric SUV? It starts with being all-Mercedes. View Inventory The Mercedes-Benz GLE is the elite crossover SUV that you have been searching for. With the functionality of passenger seating for five to seven. The Mercedes-Benz GLC has been completely redesigned inside and out. Check out the biggest changes and talk with a Fletcher Jones Motorcars Team Member. The horsepower 63 model is joined by a new range-topping hp 63 S. This SUV is all about balance, mixing brutal AMG power with Mercedes luxury. Mercedes-Benz GLA-Class models. The Mercedes-Benz GLA is a small crossover SUV available in GLA , AMG GLA 35 and AMG GLA. The Mercedes-Benz GLE is a mid-size, five-seat SUV that's powerful, luxurious, spacious, safe, swoopy, and fun to drive, especially in hot AMG versions. Used Mercedes-Benz SUVs for Sale. Nationwide · Used Mercedes-Benz. GLC SUV 4MATIC · Used Mercedes-Benz. GLC SUV RWD · Used Mercedes-. The GLA-Class is a small SUV with a big personality, but it's up against some tough competition in the ever-expanding subcompact luxury SUV class. For example. The Mercedes-Benz GLC is the brand's mid-size, five-seat crossover SUV. With a long list of lavish features and extravagant options, it is as sumptuous as any. Styled to stand out and sized to fit in, the Mercedes-Benz GLA SUV is a premium compact luxury SUV that's adventurous and adaptable. Engaging driving dynamics. New Mercedes-Benz GLC GLC SUV Graphite Grey Metallic for sale - only $ EPA Classification: Small SUV 4WD; Passenger Capacity: 5; Base Curb. The GLA is the brand's most cost-effective SUV, so you're bound to find one that fits into your preferred price bracket. In their latest GLA review, Edmunds. The Mercedes-Benz GLC-Class is a leader in the compact luxury SUV segment for its blend of style, performance, and premium features. Mercedes-Benz SUVs for Compact and Nimble Mercedes-Benz GLA. The Mercedes-Benz SUV models start with the compact and lively Mercedes-Bnez GLA. Despite. Mercedes-Benz SUVs for Compact and Nimble Mercedes-Benz GLA. The Mercedes-Benz SUV models start with the compact and lively Mercedes-Bnez GLA. Despite. When you desire the nimbleness of a compact SUV and the class of a luxury automobile in San Diego, the Mercedes-Benz GLA fulfills your wish. and it's. Note: This interior review was created when the Mercedes-Benz GLA-Class was new. The Mercedes-Benz GLA has a mixed interior quality, with some. Go green with our Mercedes-Benz GLA SUVs. These SUVs have all of the modern conveniences of most SUVs but leave behind a much smaller carbon footprint. The Mercedes-Benz EQB Is a Fully Electric Small Luxury SUV | Doug DeMuro My brother in Christ this is a 3-row SUV that's x76x65". It. The Mercedes-Benz GLC is a small crossover SUV packed with luxurious features. More than that, it shows off exquisite styling and has what it takes to.

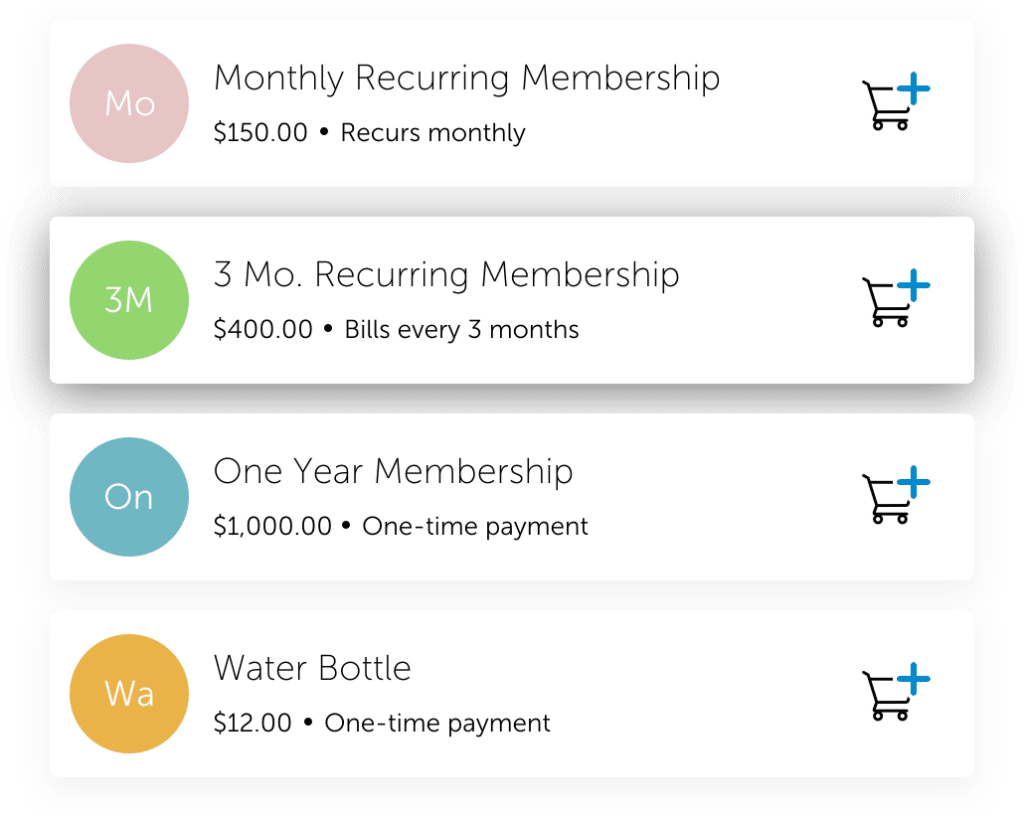

Auto Recurring Payment

Automatic payments: When you owe a certain amount of money, your payment method is automatically charged. Automatic monthly payments: Your payment method is. The Recurring Payment online feature allows bills to be paid automatically directly from a bank account or with a credit/debit card. An automatic bill payment is a money transfer scheduled on a predetermined date to pay a recurring bill, such as a mortgage or credit card bill. A recurring payment refers to a financial arrangement in which a customer authorizes a business or service provider to automatically deduct a predetermined. Create automated subscription plans & recurring payments. Create custom plans that automatically collect due credit card and ACH payments. Recurring payments, also known as automatic or scheduled payments, are financial transactions in which a predetermined amount of money is automatically. An automatic payment, also known as a subscription, billing agreement, or recurring payment, authorizes a merchant to charge you without signing in to your. You can process Auto Billing by receiving a reminder when it's time to process a tenant's payment or by setting up Automated Batch Processing and removing the. Automatic recurring payments can be charged to a credit card or directly debited from a bank account depending on what the merchant offers and what the customer. Automatic payments: When you owe a certain amount of money, your payment method is automatically charged. Automatic monthly payments: Your payment method is. The Recurring Payment online feature allows bills to be paid automatically directly from a bank account or with a credit/debit card. An automatic bill payment is a money transfer scheduled on a predetermined date to pay a recurring bill, such as a mortgage or credit card bill. A recurring payment refers to a financial arrangement in which a customer authorizes a business or service provider to automatically deduct a predetermined. Create automated subscription plans & recurring payments. Create custom plans that automatically collect due credit card and ACH payments. Recurring payments, also known as automatic or scheduled payments, are financial transactions in which a predetermined amount of money is automatically. An automatic payment, also known as a subscription, billing agreement, or recurring payment, authorizes a merchant to charge you without signing in to your. You can process Auto Billing by receiving a reminder when it's time to process a tenant's payment or by setting up Automated Batch Processing and removing the. Automatic recurring payments can be charged to a credit card or directly debited from a bank account depending on what the merchant offers and what the customer.

When transactions run automatically, you can spend less time chasing after unpaid invoices and focus more of your time on serving your clients and working. Automatic payments's definition and meaning. What are automatic payments? Automatic payments (also referred to as automatic bill payments) are payments that. Recurring payments allow you to have your invoiced installment amount automatically withdrawn from your checking or savings account on the installment due date. Recurring payments, often referred to as AutoPay, mean a consumer has given permission for a retailer or merchant to deduct payments for goods or services from. Recurring payment is a model where funds are automatically deducted from a customer's account at scheduled intervals to cover the customer's subscription fees. Recurring payments are easy with googlepage.ru's Automated Recurring Billing tool for submitting and managing subscription-based transactions. A recurring billing or recurring payment is when a merchant automatically charges a customer for goods or services on a prearranged schedule. A recurring billing or recurring payment is when a merchant automatically charges a customer for goods or services on a prearranged schedule. Set up recurring payments today and experience simpler management of monthly bills. With online bill payment, you can keep track of current or past payments. You have the ability to require your clients to enroll in automatic payments for recurring invoices. Once enrolled in autopay, your client is automatically. Recurring Payments, also known as auto-billing or auto payments / autopay, allows you to automatically charge a client's credit card, bank transfer (ACH). Recurring payments, also known as subscription payments, are charged automatically to a customer's credit card or bank account at periodic intervals. Recurring billing is the process that underpins recurring payments. It automatically charges customers for goods or services at predetermined intervals, such as. Sign in to manage your automatic payments. Prevent lost revenue and disruption to the customer experience with automatic payment retries, proactive email notifications before a payment fails, and. It is very common to set up what we call an "Automatic Payment", which is simply a recurring payment into someone else's account each week/fortnight/month. Automate revenue operations by enabling automated payment processing cycles for customers. Opt for statement auto pay or a set recurring charge. Manage recurring payments in a few quick steps. Save time and boost cash flow by setting up payments once and letting transactions process automatically. Automatic payments: When you owe a certain amount of money, your payment method is automatically charged. Automatic monthly payments: Your payment method is. To schedule bi-monthly automatic recurring payments, login to your Upstart account and click on "Add/Edit a Recurring Payment." Then select the "Bi-monthly.

Can Creditors Come After Life Insurance

Being a personal representative means you can use estate assets to settle your loved one's debts, after making payments to survivors according to state law. Collectors can contact relatives or other people connected to the deceased (who don't have the power to pay debts from the estate) to get the contact. Once the life insured dies, the insurance pays out the proceeds to the beneficiary. At that point, the cash is in the hands of the beneficiary and can be. When you file for your life insurance policy, you can designate a primary beneficiary and contingent beneficiary to receive your assets. · After a policyholder. In New York, for instance, policy proceeds cannot be attached by a beneficiary's creditors if the beneficiary is the insured's spouse. Notably, life insurance. When I bought my life insurance policy, the agent said it would be "paid up" after ten years, but it's been that long and I'm still getting bills. · Who can take. Look, creditors can't just take the money listed for beneficiaries of a life insurance policy. That's because the money is designated solely to go to the. But even though it's now in your estate, you can't ignore the debts. Creditors can apply for an 'Insolvency Administration Order' within five years of the death. NO. ONLY your designated beneficiaries get the benefits unless you have creditors listed on your policy as primaries. There is no exception to. Being a personal representative means you can use estate assets to settle your loved one's debts, after making payments to survivors according to state law. Collectors can contact relatives or other people connected to the deceased (who don't have the power to pay debts from the estate) to get the contact. Once the life insured dies, the insurance pays out the proceeds to the beneficiary. At that point, the cash is in the hands of the beneficiary and can be. When you file for your life insurance policy, you can designate a primary beneficiary and contingent beneficiary to receive your assets. · After a policyholder. In New York, for instance, policy proceeds cannot be attached by a beneficiary's creditors if the beneficiary is the insured's spouse. Notably, life insurance. When I bought my life insurance policy, the agent said it would be "paid up" after ten years, but it's been that long and I'm still getting bills. · Who can take. Look, creditors can't just take the money listed for beneficiaries of a life insurance policy. That's because the money is designated solely to go to the. But even though it's now in your estate, you can't ignore the debts. Creditors can apply for an 'Insolvency Administration Order' within five years of the death. NO. ONLY your designated beneficiaries get the benefits unless you have creditors listed on your policy as primaries. There is no exception to.

The insurer may contest a life insurance policy during the first two years after its date of issue. If the insurer finds that a material misrepresentation was. It's typically used to ensure you can paydown a large loan like a mortgage or car loan. The face value of a credit life insurance policy decreases. Consequently, creditors and debt collection agencies cannot come after the full value of the trust. If the beneficiary only has the latest $, payment. If you personally are listed as beneficiary of the life insurance policy, the creditors should not be able to touch it. The house, car, and any. If you do have outstanding debts after you pass away, there is a chance that creditors will be able to go after the benefits of your life insurance policy in. Because the funds disbursed in the payout of a life insurance policy are not considered a part of the decedent's estate, creditors will typically not be able to. (c) This section does not prohibit a creditor from collecting a debt life insurance policy pledged by the insured as security for the debt. (d) A. If beneficiaries are not named, proceeds may go into the estate. If life insurance proceeds go into an estate, distribution follows the will or per state laws. (c) This section does not prohibit a creditor from collecting a debt out of the proceeds of a life insurance policy pledged by the insured as security for the. HOW TO AVOID PROBATE. Does a personal representative or family member inherit all of the deceased's assets? WHEN A CREDITOR CAN STILL COLLECT AFTER 6 MONTHS. Creditors are usually only interested in matured assets, so bankruptcy does not typically impact an existing term life insurance policy because these policies. Once the life insured dies, the insurance pays out the proceeds to the beneficiary. At that point, the cash is in the hands of the beneficiary and can be. Law § (b)(3) (McKinney ) would exempt the life insurance proceeds from the reach of the creditors of the insured (i.e., the deceased husband) and, the. If surety on the bond is required, it can be provided by the agreement of an insurance company to back up the bond. This insures that there will be funds to. (1) The lawful beneficiary, assignee, or payee of a life insurance policy creditors and representatives of the insured and of the person effecting. It is possible that life insurers can go after the life insurance money that you have received as a designated beneficiary when you are the borrower. Creditors. When any insurance is effected in favor of another, the beneficiary shall be entitled to its proceeds against the creditors and representatives of the person. creditor of: 1. The person whose life is insured by the related policy or contract;. 2. The person who can, may, or will receive the benefit of that. In most cases, the proceeds of a life insurance policy will go directly to a nominated beneficiary and will not form part of the estate. However, if no. Creditors must file a claim with the court for the amounts due within a fixed period of time. If the executor approves the claim, the bill is paid out of the.

Open Bank Account And Get Money

Discover National Bank's banking accounts packages & get your contactless debit card now. Open a bank account online in 5 minutes. There are free online bank accounts—both checking and savings—that require no deposit. Some banks will require you to put a little money in your account when. Get up to $ cash after you open a CIBC Smart Account, then open your first CIBC eAdvantage® Savings Account and complete all qualifying actions. Cash back. Truist Enjoy Cash Credit Card. Earn unlimited rewards. You choose how. Open an account. - View Disclaimer · Get the most out of your account. If you opt to set up direct deposit, you'll receive up to $ in bonus cash† and be. Citizens Checking Accounts. Choose the account that's right for you. With features like Citizens Paid Early™ which lets you get paid sooner—up to 2 days early. Check out the best bank promotions in Canada. Browse new bank account offers including cash, rewards points, bonus interest rates and more. Open your online checking account in minutes and get access to over 55, no‑fee ATMs and zero account fees. Plus, get your paycheck up to two days early. Open an account that goes beyond the everyday. Plus, earn up to $ with a Scotiabank banking package and an investment plan. Discover National Bank's banking accounts packages & get your contactless debit card now. Open a bank account online in 5 minutes. There are free online bank accounts—both checking and savings—that require no deposit. Some banks will require you to put a little money in your account when. Get up to $ cash after you open a CIBC Smart Account, then open your first CIBC eAdvantage® Savings Account and complete all qualifying actions. Cash back. Truist Enjoy Cash Credit Card. Earn unlimited rewards. You choose how. Open an account. - View Disclaimer · Get the most out of your account. If you opt to set up direct deposit, you'll receive up to $ in bonus cash† and be. Citizens Checking Accounts. Choose the account that's right for you. With features like Citizens Paid Early™ which lets you get paid sooner—up to 2 days early. Check out the best bank promotions in Canada. Browse new bank account offers including cash, rewards points, bonus interest rates and more. Open your online checking account in minutes and get access to over 55, no‑fee ATMs and zero account fees. Plus, get your paycheck up to two days early. Open an account that goes beyond the everyday. Plus, earn up to $ with a Scotiabank banking package and an investment plan.

Why you'll love it: You get an interest-earning checking account with access to financial tools and benefits to help you manage your money. Get overdraft. Early direct deposit—with direct deposit, get your money up to two business days early A checking account that students can open on their own with tools like. Early direct deposit—with direct deposit, get your money up to two business days early A checking account that students can open on their own with tools like. Make a deposit to start banking. Transfer money into your new account. Then, register for digital banking to get started. Earn up to $ with a Scotiabank banking package and TFSA, RRSP or FHSA with all the perks that will help you spend, save and invest. Find out how our. Get up to $ cash after you open a CIBC Smart Account, then open your first CIBC eAdvantage® Savings Account and complete all qualifying actions. You can also save money by not having to pay check-cashing fees. 4. You can make online purchases with ease and peace of mind. Some bank accounts provide you. Find a bank account with the features you need to pursue your financial goals. Explore options from Bank of America and open a bank account online today. Cash back deals. Want to put more in savings? Search participating merchants and earn up to 10% cash back on everyday purchases. U.S. Bank offers as much as $ in cash when you open a new checking account Within 90 days of account opening, enroll in online banking or get the U.S. Bank. Open an eligible RBC chequing account and get the new iPad, plus start earning Avion points, get free Interac e-transfers and unlock more powerful benefits. Discover our chequing accounts with unlimited transactions, free Interac e-Transfer transactions or low monthly fees. Open a TD chequing account online. 1. Open a checking account online with the coupon code or enter your email address to get your coupon and bring it to a Chase Branch to open an account. · 2. When you open a bank account with Capital One it means no waiting in line A kid-friendly savings account for earning interest and growing their money. A savings account is for setting aside money for longer-term goals. Savings accounts earn interest and may offer an ATM card for making deposits and getting. A smarter way to spend, save and plan ahead is here. Open a checking account and get access to Erica, 1 your virtual financial assistant right in the Mobile. A minimum opening deposit of $25 to activate your account (once you've been approved). This can be paid with a credit, debit or prepaid card, a transfer from. Cash back. Truist Enjoy Cash Credit Card. Earn unlimited rewards. You choose how. Deposit checks with mobile deposit · Add cards to your digital wallet · Send and receive money with Zelle · Get help with Fargo® virtual assistant · View your. Learn how to earn hundreds of dollars by opening one of these bank accounts Bank; money transferred from another U.S. Bank checking account doesn't qualify.

Gusto Savings Account Review

Gusto Cash Accounts 1 are interest-bearing 2 bank accounts designed to help employees save automatically and spend confidently. Gusto Pricing · Gusto Discount: Get 15% cashback + 6 months free · Pricing starts from: $46/month · View more. Simplifies everything- highly recommended for small business. Gusto was a life saver for our small business. It removed our need to hire dedicated HR in house. Savings goals: Employees have access to interest-bearing bank accounts to help them bridge payday and savings, making it easier to save for the unexpected and. Gusto's cloud-hosted payroll is a favorite of reviewers with top-rated customer service. Not to mention, it has a small business-friendly price tag. Gusto wallet. Requesting time off. Saving. Read full review. Stellar!! Rating money directly into my bank account. I get my W-2 directly from the. The Gusto spending account can help employers simplify payroll by enabling employees to be paid via direct deposit instead of paper check. With the spending. Now employees paid through Gusto can put their money to work with Gusto Wallet. Gusto Wallet helps you earn, save and spend right within your Gusto account. Higher interest: With % Annual Percentage Yield, your money grows even faster in both your Spending account and Savings goals. · One free out-of-network ATM. Gusto Cash Accounts 1 are interest-bearing 2 bank accounts designed to help employees save automatically and spend confidently. Gusto Pricing · Gusto Discount: Get 15% cashback + 6 months free · Pricing starts from: $46/month · View more. Simplifies everything- highly recommended for small business. Gusto was a life saver for our small business. It removed our need to hire dedicated HR in house. Savings goals: Employees have access to interest-bearing bank accounts to help them bridge payday and savings, making it easier to save for the unexpected and. Gusto's cloud-hosted payroll is a favorite of reviewers with top-rated customer service. Not to mention, it has a small business-friendly price tag. Gusto wallet. Requesting time off. Saving. Read full review. Stellar!! Rating money directly into my bank account. I get my W-2 directly from the. The Gusto spending account can help employers simplify payroll by enabling employees to be paid via direct deposit instead of paper check. With the spending. Now employees paid through Gusto can put their money to work with Gusto Wallet. Gusto Wallet helps you earn, save and spend right within your Gusto account. Higher interest: With % Annual Percentage Yield, your money grows even faster in both your Spending account and Savings goals. · One free out-of-network ATM.

With direct deposit, payments are deposited into each worker's bank account automatically on payday. Prepaid debit cards work similarly: Payments are deposited. Direct deposit will allow the money to be placed directly into the account chosen by the employee. Prepaid debit cards are automatically loaded with the funds. When you set up your Gusto account, we'll ask for a default company bank account to debit for wages, taxes, and your monthly Gusto fee. You can add other bank. Now employees paid through Gusto can put their money to work with Gusto Wallet. Gusto Wallet helps you earn, save and spend right within your Gusto account. Modern payroll built for small businesses. Gusto was designed and engineered to make payroll, benefits, and HR easier for small and medium sized businesses. Pros: Gusto is super easy for the user. You are able to edit your info/account info for direct deposit quickly and easily. Cons: The only issue I have is that. Later, if employees leave your company, they can opt to keep their cash accounts, and have their next employer direct deposit into an FDIC-insured Gusto account. Managing payroll, compliance, and employee benefits for small businesses can be tough, but Gusto's all-in-one platform has simplified this for me. It allows me. DON'T USE GUSTO. My company started using them for the first time January 1st, We were up-sold health insurance. We received an approval email and they. "I like Gusto and I am satisfied with there product. Integrated benefits are nice especially Guideline k and health insurance integration." "It has been. Smart paycheck management with the Gusto Wallet app · Automatic short-term savings built right into payday · Long-term savings accounts for your team and their. Why customers love Gusto. · “Onboarding and communication with employees is amazing with Gusto, especially at year-end.” · "Gusto helps streamline new employee. Banking services provided by nbkc bank, Member FDIC. The Gusto Savings goals and Gusto Spending account Annual Percentage Yield (APY) as of January 3, , is. The Gusto debit card is very similar to the direct deposit and gives employees access to their funds without any need to print checks. The paystubs generated by. We use Gusto as our payroll system to make sure myself and my fellow coworkers get paid by direct deposit every two weeks. I really like their easy to use. Unlike ADP, Gusto does not provide them. Instead, workers can apply for Gusto Spending Accounts, which allow companies to pay employees via direct deposit. Gusto also offers optional plans for dental, vision, retirement, health savings accounts (HSAs) and flexible spending accounts (FSAs); commuter benefits. I love how quickly and easily I was able to pay myself through Gusto. Set up is easy and simple. Paying myself through direct deposit is simple and easy, even. You can enroll from your Gusto account and review transactions, claims, and more in the Gusto Benefits Card Manager.